who claims child on taxes with 50/50 custody stimulus

Who claims child on taxes with 50 50 custody. Heres a rundown of.

The Federal Tax Deadline Is April 18 2022 What You Should Know For Your Refund Life Kit Npr

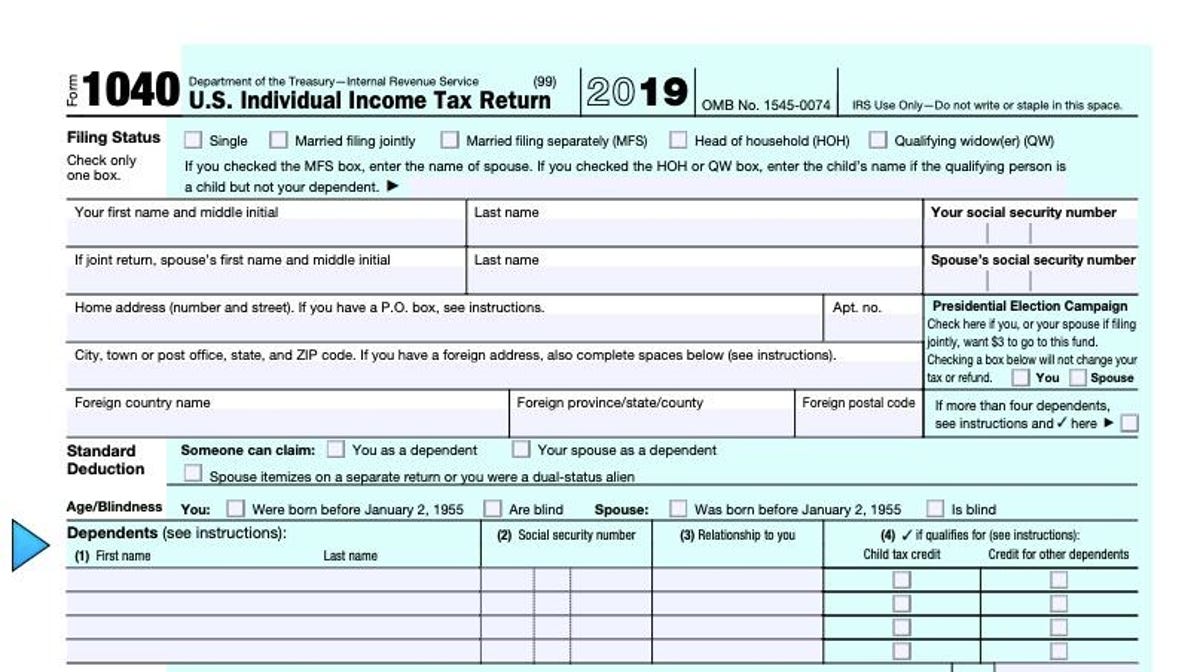

The tool allows for people to claim the 1400 stimulus checks child tax credit and earned income tax credit for the 2021 tax year.

. Can the noncustodial parent claim. What payment amounts are you eligible for. Parents Can Decide Who Will.

Receive a monthly email newsletter with insider information and special offers just for our friends by entering your. 17 deadline is for claiming both missing stimulus check and qualifying child tax credit payments. Who Claims a Child on Taxes With 5050 Custody.

The court has ruled joint parenting time or custody with both you and your spouse spending approximately equal time with your child. Parents can also come to a mutual agreement regarding which of them will claim the child when filing for taxes. The only exception to this is if the court says otherwise or if the custodial parent signs a form called the Release of.

1200 sent in April 2020. The largest child care tax credit a parent can claim is 600. However if you and your former.

This is true for parents without an exact 5050 custody split Again the rule for claiming children on your taxes is relatively. Typically when parents share 5050 custody they alternate. FAQs About Tax Deductions With Joint.

Who Claims Child on Taxes With 50 50 Custody. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Basically the custodial parent claims the dependent child for tax benefits.

The one who had custody for more than 12 of the year can claim the child as a dependent child care expenses earned income tax credit and if eligible Head of Household. The parent with the higher adjusted gross income. Taxes can be intimidating.

In this video Eric Bononi founding partner of Bonon. The IRS has put rules in place to make tax filing fair for parents who have 5050 custody. Generally IRS rules state that a child is the qualifying child of the custodial parent and the custodial parent may claim the child.

Parents Can Decide Who Will Claim a Child on Tax Returns. If you were named the primary possessor and you adhere to the PSO you will have the right to claim children as dependents on your tax returns. So one parent claims for the child.

Generally IRS rules state that a child is the qualifying child of the custodial parent and the. To claim the child care tax credit the child must spend more than 50 of their time with you. Under IRS tiebreaker rules theyd be entitled to claim the child as a dependent assuming your equal custody arrangement remains in place.

Want to stay in touch with Colorado Legal Group. If no parent claims the child despite qualifying to do so a third party eg a relative can claim the child so long as they have a higher AGI than either parent. The parent with whom the child.

The parent who has custody for the greater part of the year typically gets to claim the child as a dependent for tax purposes. Enhanced child tax credit. For a confidential consultation with an experienced child custody lawyer in Dallas.

Shared custody can create a situation where one parent gets to claim the child as a dependent. Who Claims a Child on US Taxes With 5050 Custody. To finish our FAQ series we will cover questions that overlap with the firms other areas of practice.

How Do Child Support Offsets Affect Tax Refunds And Stimulus Checks

A Guide To Stimulus Checks And Child Tax Credits Coloradobiz Magazine

How Divorce Complicates The Covid 19 Stimulus Checks

Who Claims A Child On Taxes With 50 50 Custody Smartasset

Who Claims A Child On Us Taxes With 50 50 Custody

2021 Child Tax Credit And Shared Custody What Parents Need To Know Cnet

How Does Child Tax Credit Work For Divorced Parents And Other Non Traditional Families The Washington Post

New Stimulus Payments Arrived Wednesday Here S How Much And The Future Of The Payments Wbff

Payment Status 2 Not Available How To Get Your Stimulus Check Kens5 Com

Usa Finance And Payments Summary News May 10 As Usa

Part 2 Stimulus Checks Divorce Who Takes The 2021 Child Tax Credit West Coast Family Mediation

Stimulus Check Disputes How Couples Can Resolve Them

The New Monthly Stimulus Checks For Families How Do You Get Them And When

Taxes The Cares Act Hickey Hull Law Partners Arkansas Divorce Attorney

Biden S Covid Stimulus Is The Biggest Economic Relief Yet Here S What That Means For You Salon Com

The New Monthly Stimulus Checks For Families How Do You Get Them And When

Custody Does Matter When Filing Your Taxes 2020 Update Andalman Flynn Law Firm

What To Do If My Parents Claimed Me On Their Taxes

Who S A Dependent For Stimulus Checks New Qualifications How To Claim 2020 Babies Cnet